You Probably Shouldn’t Trade

(But if you do, you should probably try and be a bit less crap at it)

My name is Scott Phillips… I’ve earned my living trading the markets since 2007.

I have accumulated 8 figures in wealth from trading… and I think you probably shouldn’t trade.

But if you have your heart set on it, you should probably try and be a bit less crap at it.

I can help with that.

The first, and most important thing you can do to tilt the odds in your favor is to pick the easiest table to sit at. (Just like poker, innit?)

You know how the stupidest people you know seem to make a lot of money in real estate?

Well crypto is the trading version of that.

Who do you want to trade against? Some physics PhD who was winning Chinese math competitions before he was 10?

Or the guy who paid 3.4 million for this?

Truth is, I’m not good enough to make a living picking stocks (though it was possible about 30 years ago), and neither are you.

My stock investments are limited to index funds, and yours should be too.

But in crypto, I’m feared as an absolute assassin. Not because I’m so amazingly good (I’m aaight tho)… just because the competition is dumb as a bucket of hair.

The first problem new traders run into is that there is no beginners market

Think about it for a moment.

One of the things humanity really gives all of the fucks about is pricing liquid securities (like FX, US stocks, bonds and gold)

We take the smartest people from the top universities with a proven work ethic, pay them a million dollars a year to start, and train them at vast expense.

We outfit them with the best computing power and administrative support.

Pay them bonuses running into the tens of millions of dollars a year if they can outperform their peers.

Modern institutional trading is the NFL for smart people.

Your chance of beating those people your first time out is ZERO.

Don’t believe what any of the furus say about that.

It’s all a bunch of bool-sheet.

And as bad as stock picking is, FX trading is far worse, and don’t get me started on the perma-bears telling you it’s all about to crash.

Fuck those clowns.

Know this: No retail trader in the history of time has made a consistent profit trading FX. It’s just a scam. FX is the most efficient market in the world, and therefore the type of risks that retail traders take (mostly chart reading stuff) barely works in FX.

You can tell this because FX brokers are mad keen on having retail punters sign up, which is why they pay for advertising.

While we are on the subject of scams. The *entire* prop trader industry is a complete and total fraud, start to finish.

If we are listing out dumb ways to lose all your money… No trader in the history of trading has made money being consistently short.

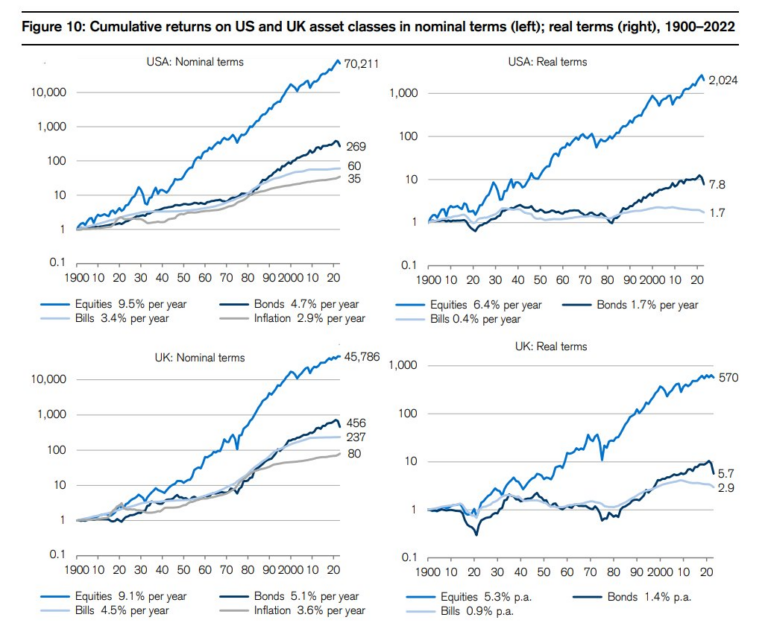

It amazes me that someone would see these charts with 100,000% returns over a century and try and bet against the march of progress

Make no mistake, the world is *structurally* long. All those pensions people contribute to around the world, a big chunk of that goes into stocks and so stocks MUST go up over the long run.

Don’t be a bear (or a goldbug). They sound smart and go broke.

I’ve painted a pretty bleak picture of a cruel and unforgiving world.

Is it really that hopeless?

Not quite. And I’ll get to how you actually win big at this game in a moment.

But first, a little about me.

I have been called the most interesting man on the internet.

Mainly because of my weird, hilarious and shocking story.

The short version is that I was rich and famous (I was one of the largest internet porn sellers in the world), then I went broke and went to jail.

Don’t shed any tears for me… I totally deserved it.

Got out of jail at age 31, with a great set of abs and my worldly possessions in a shoebox.

(This is me getting out of Woodford prison in the background with my best mate Lucky. The abs lasted six weeks)

I’m 50 now, and just this year I surpassed my old net worth (in nominal terms, inflation adjusted it makes me cry if I think about it)

Making it back took more heart than I knew I had.

More heart than I *did* have at the time.

I’m proud of myself, and more importantly my family is proud of me, too.

And I did it through trading. Specifically trend trading, which is one of the oldest types of trading with the most evidence backing it up.

I’ve expanded out my skillet from trend following into other types of trading as I got better, but 90% of all the money I’ve ever made is from trend following.

More about that soon… but first you need to understand there are two types of trading games we can play.

Both of them suck, but in different ways.

Anyone who tells you trading doesn’t suck just hasn’t been doing it long enough.

We can find things that are trading at the wrong price

OR

We can take on risk that other people don’t want to take

That’s it. That’s a complete list.

(Notice that drawing lines on charts isn’t on the list. To the extent technical analysis works it is just an artifact of other effects which are well understood)

Finding things at the wrong price is hard because it’s competitive.

Buying $1 worth of stock for .99c is a very attractive proposition if you can do it thousands of times a day.

And there ARE people who can do that.

You just aren’t going to be one of them. Grow the fuck up.

Finding the next Enron which is worth zero while valued at 100b is a very attractive proposition.

But you aren’t smart enough to do that. Sorry to break it to you.

No, you haven’t “discovered, through your extensive research” that the Fed is printing money and Bitcoin is gonna be the new standard or that gold is going to 100K.

Grow up… that’s a lottery ticket proposition at best.

The early bitcoin investors did so well because Bitcoin was really sketchy back then and they took on more risk, and got more reward.

That’s literally the way it works. More risk, more reward, on average (with a lot of randomness, luck and variance).

It sucks that this is true but we can use the same concept to carve out our own “buying bitcoin in 2011” scenario.

We can take on risk other people don’t want, and win big. (but it still sucks)

The whole trillion dollar investment allocation industry is based on this concept.

This is WHY stocks have a statistical tendency to go up over time.

Think about it.

Stocks are riskier than leaving your money in the bank, so it makes sense that a rational investor would want a higher return to compensate for the increased risk.

This has been true for hundreds of years, in every country in the world.

Stocks pay more over time than leaving your money in the bank because stocks are RISKER.

The flip side of that is that ain’t shit for free.

Of course there’s a catch.

Every 15 years or so stocks shit the bed.

And even worse, they shit the bed at the exact time the economy is cratering and you might be unemployed.

It hurts you at the exact time when it hurts to be hurt.

So stock investing pays, we know that. But it sucks, too.

And far more money has been lost preparing for crashes than in actual crashes.

Fuck. But good to know, right?

There are other types of risk other people don’t want… that you can get paid for taking on.

The most obvious one is insurance.

You can make a lot of money selling flood insurance… but when there’s a flood you are gonna have to pay out a lot of money.

So it sucks too, right? That’s the takeaway here… everything that makes money has an aspect of sucky-ness to it as well.

There are a whole range of things with insurance-like characteristics.

This is what the option selling game is about. (Option selling is an edge, but it sucks)

Mostly, options are overpriced because people are buying insurance, and insurance shouldn’t be free.

Selling insurance sucks too, right?

There’s a few other types of “risk premia” that you can collect as an investor.

The two most obvious ones are “value investing” and trend following.

Value investing is buying a company for less than it’s worth. It’s what Warren Buffet does.

But it sucks, because when markets are hot, investors gravitate towards fashionable stocks like Nvidia and Tesla which are trading at more than they are worth.

So you make money in the long run, but get to eat shit right at the time idiots are gloating about the easy money they are making.

Value investing truly sucks. Which is why there is money in it.

Which brings me to my favorite, and arguably the least-sucky edge in trading.

What is Trend Trading?

Trend trading is the simple idea that a stock (or a coin, bond, commodity, house, or anything else) that starts going up will probably continue to go up.

It works because of human nature.

We keep the investments we love and we sell the ones we hate.

And everybody loves a winner.

Whether it’s a hot stock, or a crypto going to the moon… we can’t wait to take leave of our senses and BUY BUY BUY when it seems like money is easy.

“This imaginary person out there — Mr. Market — he’s kind of a drunken psycho. Some days he gets very enthused, some days he gets very depressed. And when he gets really enthused, you sell to him and if he gets depressed you buy from him. There’s no moral taint attached to that.” Warren Buffet

Why Trend Trade Crypto?

What we universally see is that anything that works in the “traditional” markets is far more profitable in Crypto.

This makes sense if you think about it.

There is more risk in crypto, and you would expect to be compensated for that risk.

And there’s no denying you are taking extra risk by investing in a new market.

The thing is, the list of things that “work” is pretty well known (thanks to the tradfi hedge funds and quant firms which have figured out 99% of it)

How do I know? Well in 2019 I took my existing stock momentum system, ported it in a very shoddy and half-assed way to crypto, and it *printed* 850% in 2 years.

That system was a long way from “state of the art” and I realized there was huge opportunity if I invested the money I just made into building a pro level trend following system.

What I did is start by reverse engineering the biggest and most successful traditional trend following firm, and then I built from there.

The results have been very satisfying.

Our Sharpe ratio (reward to risk) is 1.7 after fees

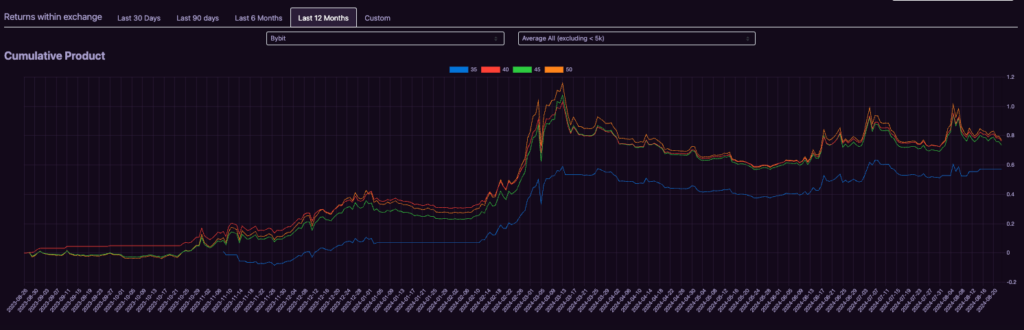

Our returns at various risk levels (you can choose higher or lower risk) look like this over the last 12 months.

Our lower risk clients have earned on average around 60% and our higher risk clients have earned around 80% for the trailing 12 months.

This isn’t a backtest or a simulation.

These are real returns (after fees). And it’s actually a little lower than usual (crypto has been a frustrating market this year).

But the system keeps winning.

It kinda sucks to do though. There are long periods of sideways chop, then it prints.

If investing in the markets was free money for taking no risk, everyone would do it and the returns would go down.

You should be comforted by the suckiness of the returns.

Because if it didn’t suck, why would anyone pay YOU to do it?

Would you like me to handle all that sucky trading FOR YOU?

I don’t mean I want you to give me your money, that’s crazy.

You can hook your crypto wallet or exchange account up to my trading system and it can do the necessary for you.

Hands off. In the background.

The blue line is our performance (after costs) while the yellow line is Bitcoin

I know I told you it sucks, but if you zoom out a little, it’s actually pretty great.

The one thing you have to do is just trust it. There’s gonna be long periods of it doing barely anything. Sometimes for months at a time.

But at the end of every year it makes money.

Every single year since 2019.

Around 100%/year on average.

Full disclosure: This year was a little below average at 80% for the trailing 12 months

Better than a poke in the eye with a sharp stick, though?

And the beautiful part is that normal crypto investors have to deal with 80%-90% drawdowns in bear markets.

By trading with the trend (up OR down) we are able to profit in both bull AND bear markets.

We’ve been profitable every single year since 2019.

Every person who has ever used this system has made money. No exceptions. No weasel words or fine print.

And we’ve earned risk adjusted returns (Sharpe ratio for you nerds) as good as Warren Buffet and Ray Dalio put together.

If you’d like to learn more about my trading system and how it works I put together a detailed explanation of how it all works.

And when you are ready to onboard to fully automated trading one of my team will walk you through the onboarding process HERE

— Scott