The objective facts about trading with moving average crossovers.

The basics: Couldn’t be simpler. You pick a fast moving average and a slow moving average

Buy when the fast moving average crosses over the slow one. Sell when it crosses back.

Obviously, the simplicity of this strategy makes it magnetically attractive to idiots, but that’s not the whole story. There are a lot of ways to build valid trading systems out of moving averages, but moving averages by themselves have no predictive value.

That’s really, really important so I’ll say it again.

Moving Averages Have No Predictive Value.

But why do they look like they work so well?

Well, that’s your monkey caveman DNA messing with your head, trader. Our brains aren’t built for trading and we don’t notice many losing periods when we “at a glance” check any strategy. It’s essential to test on a large data set.

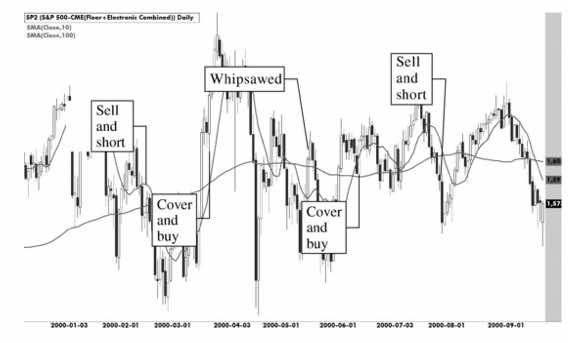

It is entirely possible to get whipsawed for long periods with a moving average crossover strategy. This is *extremely* frustrating.

So Whats a Moving Average?

Fuck on off back to investopedia, thats what it is!

No seriously, start fucking off and I’ll tell you when you’ve fucked off enough to stop.

TL:DR Here’s the summary points if you are too lazy/incapable of reading

- Moving average crossovers are a strong edge on a diversified portfolio of futures markets (this is what is known as “classical trend following”)

- Moving average crossovers are an edge, but an edge with a LOW win rate

- Doing moving average crossovers on INDIVIDUAL stocks/currencies is a total waste of time. The edge is in the whole portfolio.

- Golden cross/death cross has nothing going for it but a cool name

- By definition moving average crossovers are LAGGING

- There is ZERO predictive ability in them, but fortunately we don’t need to predict the market to make money

Don’t use moving average crossovers on individual stocks!

The win rate on moving average systems varies between 25% and 31% depending on the parameters chosen. That sucks, right?

Well… NO, it doesn’t suck. The win rate doesn’t matter much, what matters more is how big the wins are compared to the losses. And some of the winners are very big indeed.

If you think about it, on the very strongest moves, like the crash of 2008, the bull market 2009-2020, the coronavirus crash of 2020… ANY reasonably chosen moving average pair would have got you positioned right for the best part of the move.

The problem is that this strategy relies on outliers and crisis events, which by definition don’t happen much.

So you need a LARGE UNIVERSE of instruments to trade.

Arguably, with quantitative easing and seemingly permenantly low interest rates and inflation, correlations between markets have increased… reducing the effectiveness of this strategy. The glory days of trend following (of which MA crossovers are a subset) was the high inflation/high interest rate periods of the 1970’s-1990.

My pet theory is that these strategies will come back in vogue, after all they have worked for hundreds of years and never failed. “This time it’s different” my ass!

Variations on moving average formula

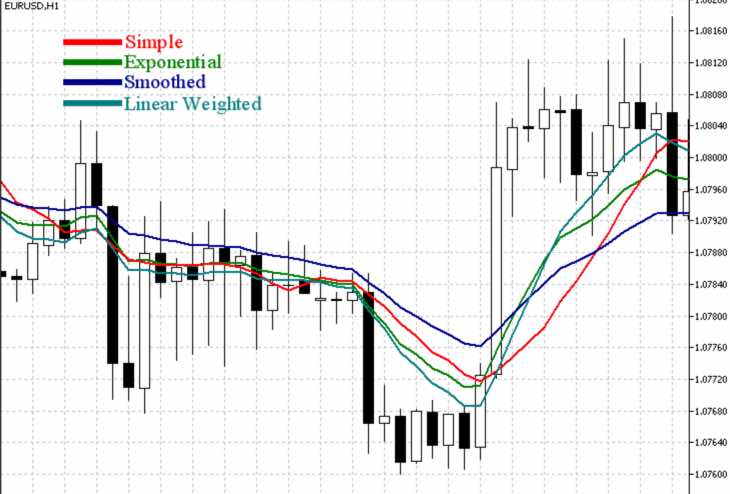

There are a bunch of modified moving average formula which pretty much all try and do the same thing… solve the inherently lagging nature of moving averages.

Yeah, they do this to one degree or another. Exponential moving averages, adaptive moving averages, smoothed moving averages, linear weighted moving averages… it’s not necessary to get fancy.

A standard exponential moving average is a good trade-off between complexity and accuracy, and you can see the differences between them below.

Using moving average crossovers in trading systems

There are two main ways that moving averages are used in trading systems. Firstly as entry/exit signals, and secondly as a trend filter

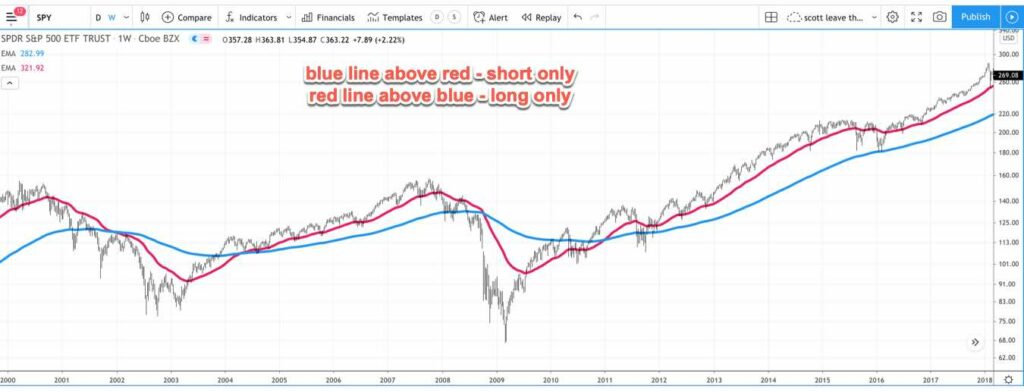

Moving averages as a trend filter

Almost ANY trading system can be improved by applying a moving average trend filter.

How this works is you take any trading system, and when your trend filter is bullish you ONLY take long trades. And when your trend filter is bearish you ONLY take short trades.

Sounds stupid-simple, but this is the secret sauce behind hundreds of billions of dollars of institutional money being traded.

I’ve tested all kinds of different trend filters and the simple ones perform nearly as well as the complicated ones.

The three most common trend filters for trading systems

200 period simple moving average

Moving average crossover

Multiple moving averages

I have a very, very comprehensive course on building trading systems, you can get HERE

I have a free training on my very best trading system, which is ridonculously consistent and has very low drawdowns. You can check it out here

Hope that helps

Scott Phillips